idaho sales tax rate 2020

Cities with local sales taxes. With local taxes the total.

Sales Taxes In The United States Wikiwand

The County sales tax rate is.

. Plus 3125 of the amount over. Plus 3625 of the amount over. These rates are weighted by population to compute an average local tax rate.

As of January 2020 however there are no sales tax. Plus 1125 of the amount over. Their taxable income on Form 40 line 19 or Form 43 line 41 is 25360.

What is the sales tax rate in Idaho City Idaho. The minimum combined 2022 sales tax rate for Boise Idaho is. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax.

Brown are filing a joint return. The Idaho City sales tax rate is 0. The Idaho sales tax rate is currently 6.

The current total local sales tax rate in Boise ID is 6000. The minimum combined 2022 sales tax rate for Idaho City Idaho is 6. Idaho has state sales.

Simplify Idaho sales tax compliance. Idaho Income Tax Rate 2020 - 2021. Prescription Drugs are exempt from the Idaho sales tax.

Did South Dakota v. Cascade - 208. Download all Idaho sales tax rates by zip code.

What is the sales tax rate in Idaho Falls Idaho. Currently combined sales tax rates in Idaho range from 6 to 9 depending on the location of the sale. This is the total of state county and city sales tax rates.

EIN00046 12-21-2020 Page 52 of 63 Use the following tables if your taxable income is less than 100000. A City county and municipal rates vary. The Boise sales tax rate is.

Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9. Raised from 6 to 7. If your taxable income is 100000 or more use the Tax Rate Schedules on page 63.

2020 rates included for use while preparing your income tax deduction. California 1 Utah 125 and Virginia 1. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Idaho has a 6 statewide sales tax rate but also has 112 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top of the state tax. Plus 6625 of the amount over. State Local Sales Tax Rates As of January 1 2020.

Find your Idaho combined state and local tax rate. Did South Dakota v. The base state sales tax rate in Idaho is 6.

Boise ID Sales Tax Rate. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. This is the total of state county and city sales tax rates.

278 rows Idaho Sales Tax. 31 rows The state sales tax rate in Idaho is 6000. While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected.

The Idaho ID state sales tax rate is currently 6. B Three states levy mandatory statewide local add-on sales taxes at the state level. This is the total of state county and city sales tax rates.

The Idaho ID state sales tax rate is currently 6. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. Idaho sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Interactive Tax Map Unlimited Use. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. Contact the following cities directly for questions about their local sales tax.

Idaho sales tax rate. Average Sales Tax With Local. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate.

Wayfair Inc affect Idaho. The Idaho Falls sales tax rate is. The Idaho sales tax rate is currently.

The current total local sales tax rate in Boise ID is 6000. 2020 rates included for use while preparing your income tax deduction. The Idaho sales tax rate is currently.

The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food. Ad Lookup Sales Tax Rates For Free.

Plus 5625 of the amount over. Tax Rate. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85.

The Idaho State Sales Tax is collected by the merchant on all qualifying sales made within Idaho State. The December 2020 total local sales tax rate was also 6000. The County sales tax rate is 0.

The state sales tax rate in Idaho is 6 but you can. As a business owner selling taxable goods or services you act as an agent of the state of Idaho by collecting tax from purchasers and passing it along to the appropriate tax authority. Plus 4625 of the amount over.

EIN00046 12-21-2020 Page 52 of 63 Use the following tables if your taxable income is less than 100000. Depending on local municipalities the total tax rate can be as high as 9. Local level non-property taxes are allowed within resort cities if approved by 60 majority vote.

First they find the. Thats why we came up with this handy Idaho sales tax. California 1 Utah 125 and Virginia 1.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Sales Tax By State Is Saas Taxable Taxjar

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

State Corporate Income Tax Rates And Brackets Tax Foundation

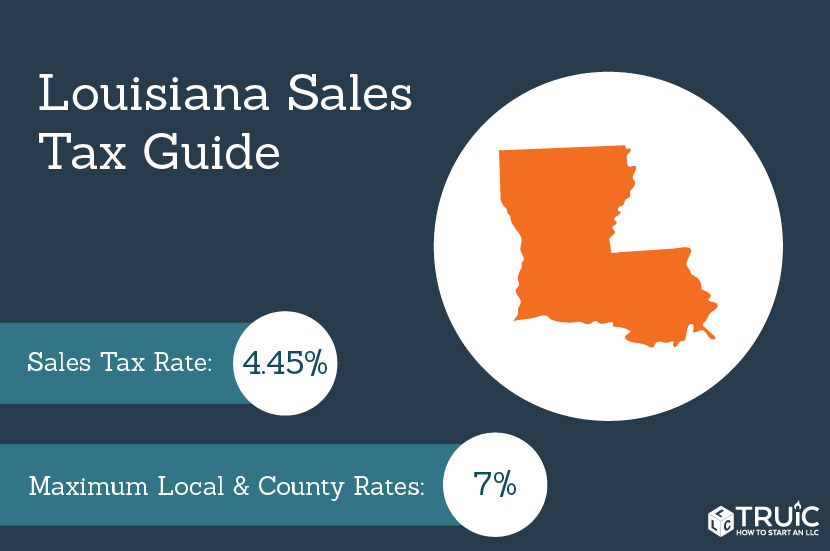

Louisiana Sales Tax Small Business Guide Truic

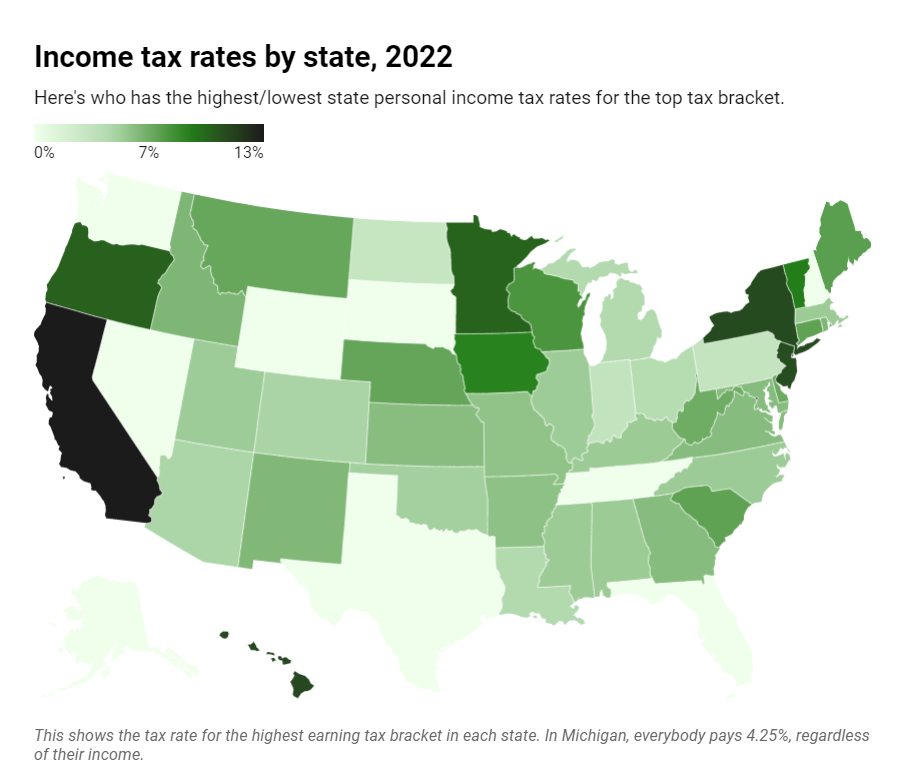

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Colorado Income Tax Rate And Brackets 2019

States With Highest And Lowest Sales Tax Rates

How High Are Cell Phone Taxes In Your State Tax Foundation

Sales Tax On Grocery Items Taxjar

States Without Sales Tax Article

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

U S Sales Taxes By State 2020 U S Tax Vatglobal

How Do State And Local Individual Income Taxes Work Tax Policy Center